How to Optimize the RSI Indicator for the Best Trading Results

How to Optimize the RSI Indicator for the Best Trading Results - The Relative Strength Index (RSI) is one of the most popular technical indicators among forex traders. However, the RSI indicator is also often accused of being easily missed or inaccurate. In fact, there are several simple ways to optimize the RSI indicator to get maximum trading results.

Theoretically, the RSI indicator always goes up and down between levels 0 and 100 along with changes in the price of a currency pair. Therefore, traders generally set a threshold level of 30 and 70 as a barrier between oversold and overbought conditions. If the indicator falls below 30, it means oversold, and the price will turn up. If the indicator breaks the level 70, it means overbought, and the price will turn down.

However, in practice, traders will often find that:

In order not to get caught up in the myth of the inaccuracy of the RSI indicator due to the two cases above, you can try applying the following steps:

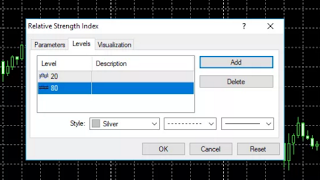

1. Slide the oversold threshold and overbought RSI to levels 20 and 80. On the Metatrader platform, an option like this will appear to customize the RSI indicator. Choose 20 and 80 so that the level is automatically marked by the platform.

This step allows traders to sort oversold and overbought signals more accurately, rather than staying on level 30-70.

2. For buy or sell trading signals, pay attention to the level 50 midline. If the RSI indicator rises above 50, it means it's time to find a moment to buy. Whereas if the RSI is below the level of 50, it means it's time to sell. Preferably, don't use oversold and overbought levels as a marker for buy or sell; but as a marker of time to close a trading position.

3. Change the period parameters on the RSI indicator according to your trading period. By default, the RSI indicator has a period 14 setting. However, short-term timeframe traders (H4 or lower) should use smaller periods, for example 9. While long-term traders should use a higher period, for example 25. This parameter can also be modified easily on the Metatrader platform. Try setting the RSI indicator this way, then practice it.

That's tips on How to Optimize the RSI Indicator for the Best Trading Results. Hopefully with these fairly short tips, it can be useful and useful for all of you who need it. Good luck.

Inaccurate RSI Indicator?

Theoretically, the RSI indicator always goes up and down between levels 0 and 100 along with changes in the price of a currency pair. Therefore, traders generally set a threshold level of 30 and 70 as a barrier between oversold and overbought conditions. If the indicator falls below 30, it means oversold, and the price will turn up. If the indicator breaks the level 70, it means overbought, and the price will turn down.

However, in practice, traders will often find that:

- The indicator does not come out from below level 30 or vice versa, does not go down from level 70, even though it has been for days. This is a "trending" market situation. If you are not ready to deal with it, then you can get stuck floating negatively for a long time and end up exposed to the Margin Call.

- The indicator does not go above level 70 or falls below level 30, even though it has been for days too. This is usually related to the "sideways" market situation and low volatility. If you are not ready to deal with it, then you will not be able to open trading positions because there is no signal.

Steps to Optimize the RSI Indicator

In order not to get caught up in the myth of the inaccuracy of the RSI indicator due to the two cases above, you can try applying the following steps:

|

| Optimizing RSI Indicators |

1. Slide the oversold threshold and overbought RSI to levels 20 and 80. On the Metatrader platform, an option like this will appear to customize the RSI indicator. Choose 20 and 80 so that the level is automatically marked by the platform.

This step allows traders to sort oversold and overbought signals more accurately, rather than staying on level 30-70.

|

| Buy or sell trading signals |

2. For buy or sell trading signals, pay attention to the level 50 midline. If the RSI indicator rises above 50, it means it's time to find a moment to buy. Whereas if the RSI is below the level of 50, it means it's time to sell. Preferably, don't use oversold and overbought levels as a marker for buy or sell; but as a marker of time to close a trading position.

3. Change the period parameters on the RSI indicator according to your trading period. By default, the RSI indicator has a period 14 setting. However, short-term timeframe traders (H4 or lower) should use smaller periods, for example 9. While long-term traders should use a higher period, for example 25. This parameter can also be modified easily on the Metatrader platform. Try setting the RSI indicator this way, then practice it.

That's tips on How to Optimize the RSI Indicator for the Best Trading Results. Hopefully with these fairly short tips, it can be useful and useful for all of you who need it. Good luck.

Post a Comment for "How to Optimize the RSI Indicator for the Best Trading Results"

Provide comments relevant to the posted articles and provide critiques and suggestions for the progress of the blog