The Simplest Trading Strategies for Beginners

The Simplest Trading Strategies for Beginners - To become a profitable forex trader, the strategy does not need to be complicated. Even beginners who are just learning can profit if the forex trading techniques used are simple and easy to understand. For this reason, this article will discuss trading strategies for simple beginners that are suitable for beginners.

Immediately let's see what trading strategies are very suitable for the following beginners.

Moving Average (MA) is the most common trend indicator that is widely used by traders. From beginners to professionals, MA is always used to identify the direction of the trend. Basically, when the MA is below the price it confirms if the current price is in a bullish trend (rising). Conversely, when the MA moves above the price, it means that the current trend is identified as bearish (decreasing).

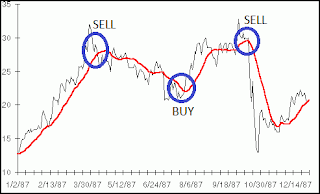

Forex trading techniques with MA usually rely on the moment of crossing (crossing) MA. When the MA crosses the price, the indicator line shifts position and indicates a change in trend direction. The picture below shows how to apply forex trading techniques with an MA for beginners.

Overbought or overbought is a condition where the price increase has reached the maximum area, so the price will then go down. Conversely, oversold or oversold indicates the condition of prices that have dropped in the lowest area, so that the next price will rise again.

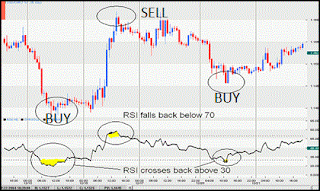

Overbought and oversold prices are not seen in movements on the chart. To see it, signal instructions from oscillator indicators such as RSI, Stochastic, CCI, etc. are needed. Apart from being different in terms of appearance, each indicator has unequal overbought and oversold benchmarks.

RSI, for example, shows an overbought limit at level 70 and an oversold limit at 30. Stochastic has levels 80 and 20, while the CCI signals overbought prices if the indicator chart crosses the +100, and oversold when the price drops -100.

With an understanding of overbought and oversold that usually brings reversal opportunities, it is not difficult for beginners to rely on both of these as a reliable forex trading technique. The chart below shows how to run a simple forex trading strategy with overbought and oversold generated from the RSI indicator.

Sideways are situations in which prices move stably and tend to be flat (not uphill as in a bullish trend or decreasing like when a bearish trend occurs). Movements like this happen quite often, but not many traders use them because they are considered less potential.

In fact, if a trader knows forex trading techniques in the sideways market, profits will be easily obtained. This strategy relies on support and resistance levels which are the lower and upper prices in a range.

Support resistance can be determined from many things, starting from the manual method by looking at price patterns, psychological levels, Fibonacci tools, or Pivot Point methods. The basic principle, when prices hit proven support, will bounce up. When the price approaches the resistance tested, the first anticipated possibility of such a move is the price bouncing down after failing to break the resistance line.

The figure below shows a simple forex trading technique with manual resistance that is pulled from the price pattern.

In contrast to the sideways strategy, this forex trading technique is effective when the market is trending. Trendline is basically a vertical line that acts as support (when prices rise) or resistance (when the price trend decreases).

Breakout occurs when prices suddenly break through the trendline and change direction. If the trendline line is tested strong, then this breakout signal can be the beginning of a reversal (price reversal). On this chart, it is clear how open buy opportunities are created after the trendline line is broken by prices that turn stronger.

Of the 4 choices of trading strategies for the simplest beginner above, there is nothing right or wrong, let alone one that is profitable or detrimental. All techniques can bring results as long as they are used correctly. Therefore, choose the strategy that you understand the most and then test the compatibility in the demo account. Learning forex is indeed difficult and difficult, but being pursued can produce unexpected benefits.

Whatever your choice of forex trading strategy will be, don't ignore these 4 important things:

Also read:

- Simple Forex Strategy using Support Resistance

- Basic Forex Trading Techniques for Beginners

These are the tips that I can share this time about The Simplest Trading Strategies for Beginners, Hopefully what I have shared, can be useful and good luck.

Immediately let's see what trading strategies are very suitable for the following beginners.

Trading Strategy for Beginners # 1: Crossing Moving Average

Moving Average (MA) is the most common trend indicator that is widely used by traders. From beginners to professionals, MA is always used to identify the direction of the trend. Basically, when the MA is below the price it confirms if the current price is in a bullish trend (rising). Conversely, when the MA moves above the price, it means that the current trend is identified as bearish (decreasing).

Forex trading techniques with MA usually rely on the moment of crossing (crossing) MA. When the MA crosses the price, the indicator line shifts position and indicates a change in trend direction. The picture below shows how to apply forex trading techniques with an MA for beginners.

Trading Strategies for Beginners # 2: Overbought and Oversold

Overbought or overbought is a condition where the price increase has reached the maximum area, so the price will then go down. Conversely, oversold or oversold indicates the condition of prices that have dropped in the lowest area, so that the next price will rise again.

Overbought and oversold prices are not seen in movements on the chart. To see it, signal instructions from oscillator indicators such as RSI, Stochastic, CCI, etc. are needed. Apart from being different in terms of appearance, each indicator has unequal overbought and oversold benchmarks.

RSI, for example, shows an overbought limit at level 70 and an oversold limit at 30. Stochastic has levels 80 and 20, while the CCI signals overbought prices if the indicator chart crosses the +100, and oversold when the price drops -100.

With an understanding of overbought and oversold that usually brings reversal opportunities, it is not difficult for beginners to rely on both of these as a reliable forex trading technique. The chart below shows how to run a simple forex trading strategy with overbought and oversold generated from the RSI indicator.

Trading Strategy for Beginners # 3: Sideways Trading

Sideways are situations in which prices move stably and tend to be flat (not uphill as in a bullish trend or decreasing like when a bearish trend occurs). Movements like this happen quite often, but not many traders use them because they are considered less potential.

In fact, if a trader knows forex trading techniques in the sideways market, profits will be easily obtained. This strategy relies on support and resistance levels which are the lower and upper prices in a range.

Support resistance can be determined from many things, starting from the manual method by looking at price patterns, psychological levels, Fibonacci tools, or Pivot Point methods. The basic principle, when prices hit proven support, will bounce up. When the price approaches the resistance tested, the first anticipated possibility of such a move is the price bouncing down after failing to break the resistance line.

The figure below shows a simple forex trading technique with manual resistance that is pulled from the price pattern.

Trading Strategy for Beginners # 4: Breakout Trendline

In contrast to the sideways strategy, this forex trading technique is effective when the market is trending. Trendline is basically a vertical line that acts as support (when prices rise) or resistance (when the price trend decreases).

Breakout occurs when prices suddenly break through the trendline and change direction. If the trendline line is tested strong, then this breakout signal can be the beginning of a reversal (price reversal). On this chart, it is clear how open buy opportunities are created after the trendline line is broken by prices that turn stronger.

How do you choose the most suitable trading strategy for beginners?

Of the 4 choices of trading strategies for the simplest beginner above, there is nothing right or wrong, let alone one that is profitable or detrimental. All techniques can bring results as long as they are used correctly. Therefore, choose the strategy that you understand the most and then test the compatibility in the demo account. Learning forex is indeed difficult and difficult, but being pursued can produce unexpected benefits.

Whatever your choice of forex trading strategy will be, don't ignore these 4 important things:

- Always pay attention to the fundamental issues that are happening. Even though you rely on technical analysis, price movements are driven by buying and selling sentiments that are often influenced by fundamentals.

- Use the price action method to confirm the indicator signal. Price action is a price pattern formed on the chart. The small or short length of the candlestick is a reflection of the behavior of buyers and sellers. So actually, you can recognize important patterns in the price action to confirm the reversal or forward signal from the indicator.

- Always apply risk management to anticipate losses. No matter how much forex trading techniques you use, there is always a chance of loss to be borne. So you should anticipate these losses by minimizing loss through risk management rules.

- Try to discipline applying forex trading techniques or also commonly called Trading Trading Discipline ‘. Without consistency, trading strategies will not work optimally, and you will more easily fall into the mistakes of beginners who still like to leave their trading techniques to speculate. Believe me, this action will not bring good in the long run.

Also read:

- Simple Forex Strategy using Support Resistance

- Basic Forex Trading Techniques for Beginners

These are the tips that I can share this time about The Simplest Trading Strategies for Beginners, Hopefully what I have shared, can be useful and good luck.

Post a Comment for "The Simplest Trading Strategies for Beginners"

Provide comments relevant to the posted articles and provide critiques and suggestions for the progress of the blog