Revealing the Basics of Forex Technical Analysis

Revealing the Basics of Forex Technical Analysis - As one of the main analyzes in forex trading, technical methods have become an integral part of trading activities. Not infrequently, traders tend to choose forex technical analysis because it is considered easier to do. Compared to fundamental analysis, technical methods do provide a more constant theory, where traders only need to see what's on the chart and interpret signals of price movements from it.

In general, forex technical analysis is done by looking at the history of price movements. Through the principle of "history always repeats", the technicalists (thus traders adhering to technical analysis are called) believe if the pattern of future movements can be predicted if traders are able to recognize historical patterns of prices that actually move in cycles.

With this theory, all kinds of forex technical analysis methods are emerging that help traders recognize signals of price movements from history. Both ways to identify trend forwarding or reversal, overbought or oversold, all forex technical analysis is based on observations of prices that have been formed.

Furthermore, traders then apply technical indicators, which are able to generate various signals from mathematical calculations of past price movements. But with the increasing variety of technical indicators, many traders have become dependent on these tools.

Not to mention, problems also arise due to confusion in installing indicators, so that a condition is created where a trader places too many indicators on a chart, does not use indicators that are understood, or even buys indicators that are not of much use. In the end, these difficulties will cause untold losses that can hinder the success of trading.

Far from the 'frenzied' indicator, there are the most basic ways in forex technical analysis that are very powerful and reliable by many experts. So many indicators in fact are able to make traders forget the basics of forex technical analysis itself, namely reading price movements.

Yes, just by looking at prices, you have done a technical analysis that can be far more useful than painstakingly choosing indicators. In this case, there are 3 basic forex technical analysis that you need to prioritize, including:

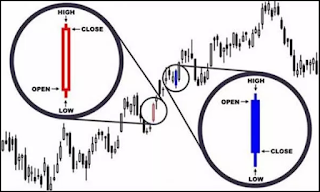

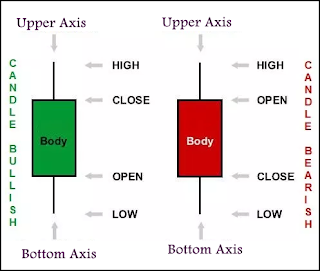

For traders who have mastered price action, not armed with technical indicators will not be a problem. That is because, in fact there is already a lot of information recorded in the pattern of price movements themselves. For example, when you use a candlestick chart, just by knowing the color, body size, and length of the axis, you can already see what the price conditions are like and what the next move will be.

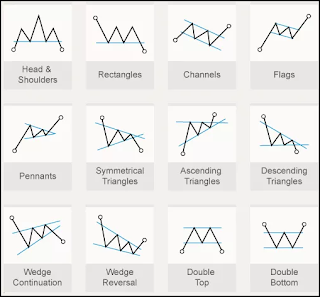

Wider than price action, there is an observation of a chart pattern (price pattern) that looks at the unique patterns on the chart. The price pattern theory uniquely identifies specific forms in price movements and makes it a signal of an important change. For example, there is a triangle pattern that indicates a breakout, head and shoulders which indicates a reversal, and a flag pattern with the forward signal.

Both the identification of the candle and price action both do not require an indicator. You can observe the price chart directly and find examples of the formations mentioned, to apply this basic forex technical analysis.

Trend is often the focus of the most preferred analysis. How not, when prices are moving fast, almost all traders want to enter the trend to share in the potential for large profits. The easiest trends are observed directly through the chart. You can see for yourself whether the price trend is rising or falling. When following the trend following strategy, the easy principle is to act in the direction of the trend; buy if uptrend and sell during downtrend.

However, trend analysis is not that easy. Even though it enters a trend that looks strong, not necessarily the price will continue to move in the same direction. Many cases actually show that traders who are 'late in entering' will lose because the trend is over when the profit collected is not much. That is why, many traders then apply the trendline and entry technical analysis object when prices bounce off the line.

One more basic forex technical analysis that cannot be ignored is resistance support, because in addition to the trend, prices also move within the limits of support and resistance. Support is the upper ceiling or ceiling which limits the highest level of price movements. That means, there are only 2 possibilities when prices reach the support level; back down after failing to break it, or breakout with strong movements after successfully penetrating it. The same technical analysis can also be used for resistance, which is the lower ceiling or ground floor of price movements.

Cover

Believe it or not, almost all of the current indicators are the result of the development of the 3 basic concepts of forex technical analysis above. For example, Moving Average and similar indicators are created to help traders analyze trends more easily. Meanwhile, the calculation of Pivot Point and Fibonacci Retracement is clearly applied to get price support and resistance levels. So for those of you who want to understand forex technical analysis from the bottom, you should first learn the 3 concepts mentioned above

Even if you prefer to use indicators later, this understanding still has an important contribution to the progress of your forex analysis. In fact, choosing the right indicator also requires expertise to recognize its various functions in technical analysis. So if you have understood the basics of forex technical analysis, then determining the best indicator is no longer a difficult matter.

Those are the tips that I discuss this time about Revealing the Basics of Forex Technical Analysis. Hopefully it can be useful and useful for all of you. Thank you for visiting, and look forward to our latest post.

In general, forex technical analysis is done by looking at the history of price movements. Through the principle of "history always repeats", the technicalists (thus traders adhering to technical analysis are called) believe if the pattern of future movements can be predicted if traders are able to recognize historical patterns of prices that actually move in cycles.

With this theory, all kinds of forex technical analysis methods are emerging that help traders recognize signals of price movements from history. Both ways to identify trend forwarding or reversal, overbought or oversold, all forex technical analysis is based on observations of prices that have been formed.

Furthermore, traders then apply technical indicators, which are able to generate various signals from mathematical calculations of past price movements. But with the increasing variety of technical indicators, many traders have become dependent on these tools.

Not to mention, problems also arise due to confusion in installing indicators, so that a condition is created where a trader places too many indicators on a chart, does not use indicators that are understood, or even buys indicators that are not of much use. In the end, these difficulties will cause untold losses that can hinder the success of trading.

Far from the 'frenzied' indicator, there are the most basic ways in forex technical analysis that are very powerful and reliable by many experts. So many indicators in fact are able to make traders forget the basics of forex technical analysis itself, namely reading price movements.

Get to know the various types of Basic Forex Technical Analysis

Yes, just by looking at prices, you have done a technical analysis that can be far more useful than painstakingly choosing indicators. In this case, there are 3 basic forex technical analysis that you need to prioritize, including:

1. Price Action Analysis and Pattern

For traders who have mastered price action, not armed with technical indicators will not be a problem. That is because, in fact there is already a lot of information recorded in the pattern of price movements themselves. For example, when you use a candlestick chart, just by knowing the color, body size, and length of the axis, you can already see what the price conditions are like and what the next move will be.

Wider than price action, there is an observation of a chart pattern (price pattern) that looks at the unique patterns on the chart. The price pattern theory uniquely identifies specific forms in price movements and makes it a signal of an important change. For example, there is a triangle pattern that indicates a breakout, head and shoulders which indicates a reversal, and a flag pattern with the forward signal.

Both the identification of the candle and price action both do not require an indicator. You can observe the price chart directly and find examples of the formations mentioned, to apply this basic forex technical analysis.

2. Trend Analysis

Trend is often the focus of the most preferred analysis. How not, when prices are moving fast, almost all traders want to enter the trend to share in the potential for large profits. The easiest trends are observed directly through the chart. You can see for yourself whether the price trend is rising or falling. When following the trend following strategy, the easy principle is to act in the direction of the trend; buy if uptrend and sell during downtrend.

However, trend analysis is not that easy. Even though it enters a trend that looks strong, not necessarily the price will continue to move in the same direction. Many cases actually show that traders who are 'late in entering' will lose because the trend is over when the profit collected is not much. That is why, many traders then apply the trendline and entry technical analysis object when prices bounce off the line.

3. Support Resistance Analysis

One more basic forex technical analysis that cannot be ignored is resistance support, because in addition to the trend, prices also move within the limits of support and resistance. Support is the upper ceiling or ceiling which limits the highest level of price movements. That means, there are only 2 possibilities when prices reach the support level; back down after failing to break it, or breakout with strong movements after successfully penetrating it. The same technical analysis can also be used for resistance, which is the lower ceiling or ground floor of price movements.

Cover

Believe it or not, almost all of the current indicators are the result of the development of the 3 basic concepts of forex technical analysis above. For example, Moving Average and similar indicators are created to help traders analyze trends more easily. Meanwhile, the calculation of Pivot Point and Fibonacci Retracement is clearly applied to get price support and resistance levels. So for those of you who want to understand forex technical analysis from the bottom, you should first learn the 3 concepts mentioned above

Even if you prefer to use indicators later, this understanding still has an important contribution to the progress of your forex analysis. In fact, choosing the right indicator also requires expertise to recognize its various functions in technical analysis. So if you have understood the basics of forex technical analysis, then determining the best indicator is no longer a difficult matter.

Those are the tips that I discuss this time about Revealing the Basics of Forex Technical Analysis. Hopefully it can be useful and useful for all of you. Thank you for visiting, and look forward to our latest post.

Post a Comment for "Revealing the Basics of Forex Technical Analysis"

Provide comments relevant to the posted articles and provide critiques and suggestions for the progress of the blog